Cross-Border Business: Why Location Doesn't Matter Anymore

Building Global DAEs Through Jurisdictional Optimization and Regulatory Intelligence

Black W3B Substack: Day 60

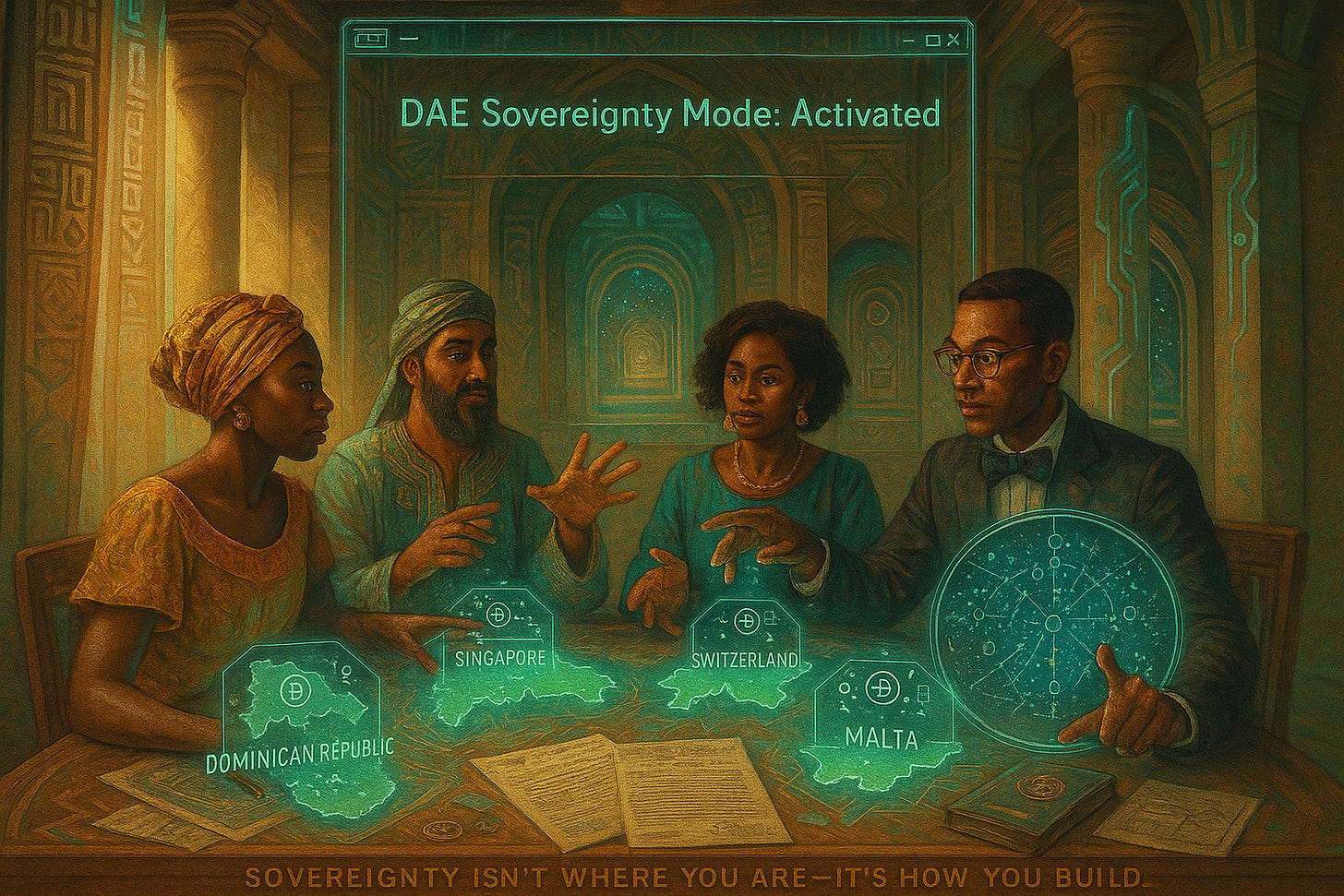

⚡ THE GEOGRAPHY REVOLUTION

Here's what most entrepreneurs don't realize: in the age of DAEs, your physical location is becoming one of your most powerful strategic advantages—but not in the way you think.

It's not about being in Silicon Valley for access to capital, or New York for financial networks, or London for regulatory clarity. It's about understanding that different jurisdictions offer different advantages for different aspects of your business, and DAE architecture lets you optimize for all of them simultaneously.

While traditional businesses are constrained by where they incorporate, DAEs can leverage the best regulations, tax structures, talent pools, and operational environments from around the world—all while serving a global customer base through decentralized infrastructure.

Today, we're diving deep into jurisdictional optimization, regulatory navigation, and the practical strategies for building truly borderless enterprises that operate beyond traditional geographic limitations.

🌀 WHY TRADITIONAL BUSINESS LOCATION THINKING IS OBSOLETE

The old rules of business location were based on physical constraints that no longer apply to DAEs:

The Capital Access Myth Traditional thinking: You need to be where the VCs are to raise money. DAE reality: Decentralized funding through token sales, DeFi protocols, and global communities eliminates geographic funding constraints.

The Talent Pool Limitation Traditional thinking: You need to be where the best talent lives. DAE reality: Remote-first operations and AI agent collaboration mean you can access global talent while minimizing human resource dependencies.

The Market Access Requirement Traditional thinking: You need to be close to your customers. DAE reality: Blockchain infrastructure and global internet access mean your customers can be anywhere, and your service delivery is location-independent.

The Regulatory Compliance Burden Traditional thinking: You must comply with regulations where you operate. DAE reality: Smart jurisdictional structuring allows you to optimize regulatory compliance while maintaining global operations.

💎 THE JURISDICTIONAL OPTIMIZATION FRAMEWORK

Here's how sophisticated DAE builders think about geographic strategy:

1. Operational Jurisdiction (Where You Live and Work)

This is where you physically reside and conduct day-to-day operations. Optimize for:

•Personal tax efficiency and wealth preservation

•Quality of life and operational costs

•Time zone advantages for global coordination

•Political and economic stability

•Internet infrastructure and connectivity

2. Legal Jurisdiction (Where Your Entities Are Incorporated)

This is where your legal entities exist on paper. Optimize for:

•Corporate tax rates and structures

•Regulatory clarity and blockchain-friendly laws

•Legal system quality and contract enforcement

•International treaty networks and banking access

•Intellectual property protection

3. Technical Jurisdiction (Where Your Infrastructure Runs)

This is where your blockchain nodes, servers, and technical infrastructure operate. Optimize for:

•Regulatory clarity for blockchain operations

•Energy costs and sustainability

•Internet infrastructure and latency

•Political stability and censorship resistance

•Technical talent availability for maintenance

4. Market Jurisdiction (Where Your Customers Are)

This is where you serve customers and generate revenue. Optimize for:

•Market size and growth potential

•Regulatory compliance requirements

•Payment processing and banking integration

•Cultural fit and localization needs

•Competitive landscape and barriers to entry

🔥 REAL-WORLD JURISDICTIONAL STRATEGIES

Let me show you how this works in practice with proven optimization strategies:

The Caribbean Command Center Strategy

Operational Base: Dominican Republic, Puerto Rico, or Barbados

•Low cost of living with high quality of life

•Favorable tax structures for individuals and businesses

•Strong internet infrastructure and US time zone alignment

•Political stability and English/Spanish language advantages

•Growing crypto-friendly regulatory environments

Legal Structure: Singapore or Switzerland entities

•Clear regulatory frameworks for blockchain businesses

•Strong legal systems and international treaty networks

•Favorable corporate tax rates and structures

•Banking access and financial services integration

•Intellectual property protection and enforcement

Technical Infrastructure: Distributed across multiple jurisdictions

•Blockchain nodes in crypto-friendly countries (Estonia, Malta, Portugal)

•Server infrastructure in low-cost, high-reliability locations

•CDN and user-facing services optimized for target markets

•Backup systems in politically stable jurisdictions

Market Focus: Global with emphasis on developed markets

•Primary markets in US, EU, and Asia-Pacific

•Compliance structures for major regulatory jurisdictions

•Localized marketing and customer service

•Payment processing optimized for each region

The Nomad Optimization Strategy

Operational Base: Location-independent with strategic rotations

•Spend time in different jurisdictions to optimize tax residency

•Leverage visa programs for entrepreneurs and investors

•Maintain flexibility to relocate based on changing conditions

•Build networks and partnerships in multiple regions

Legal Structure: Multi-jurisdictional entity network

•Holding companies in tax-efficient jurisdictions

•Operating companies in business-friendly locations

•IP holding entities in strong protection jurisdictions

•Treasury management through crypto-friendly banks

Technical Infrastructure: Fully decentralized

•No single point of failure or jurisdiction dependency

•Blockchain-native operations with minimal traditional infrastructure

•AI agents and smart contracts handle most operations

•Human oversight can happen from anywhere with internet

Market Focus: Digital-first with global reach

•Products and services designed for global delivery

•Minimal jurisdiction-specific compliance requirements

•Revenue streams that work across borders

•Customer base diversified across multiple regions

⚡ REGULATORY NAVIGATION: THE ADVANCED PLAYBOOK

Regulatory compliance for DAEs requires a different approach than traditional businesses. Here's the advanced playbook:

The Regulatory Arbitrage Principle

Instead of trying to comply with the most restrictive regulations everywhere, structure your operations to take advantage of regulatory differences:

•Incorporate in jurisdictions with clear, favorable blockchain regulations

•Operate technical infrastructure in crypto-friendly locations

•Serve customers through compliant local entities where required

•Maintain treasury and token operations in optimal jurisdictions

The Compliance Layering Strategy

Build compliance in layers that can be adjusted based on regulatory changes:

Layer 1: Core Protocol (Maximally Decentralized)

•Smart contracts deployed on censorship-resistant blockchains

•No single point of control or jurisdiction dependency

•Minimal compliance requirements due to decentralized nature

Layer 2: Interface and Services (Jurisdiction-Specific)

•User interfaces and customer service localized for each market

•Compliance with local regulations for customer-facing operations

Layer 3: Legal Entities (Optimized for Each Function)

•Different entities for different business functions

•Each entity optimized for its specific regulatory environment

•Clear separation of functions to minimize compliance overlap

The Regulatory Monitoring System

Stay ahead of regulatory changes with systematic monitoring:

•Track regulatory developments in all relevant jurisdictions

•Maintain relationships with crypto-friendly legal counsel globally

•Participate in industry associations and regulatory discussions

•Build flexibility into your structure for rapid adaptation

🌀 PRACTICAL IMPLEMENTATION: THE RELOCATION PLAYBOOK

Ready to optimize your geographic strategy? Here's a practical implementation guide:

Phase 1: Assessment and Planning (Months 1-2)

Personal Situation Analysis:

•Current tax obligations and residency requirements

•Family and personal constraints on relocation

•Business operations and customer base analysis

•Financial resources available for transition

Jurisdiction Research:

•Tax implications of different residency options

•Visa requirements and pathways for each target jurisdiction

•Cost of living and quality of life factors

•Business infrastructure and regulatory environment

Strategic Planning:

•Define your optimization priorities (tax, lifestyle, business, etc.)

•Create timeline for transition with key milestones

•Plan entity restructuring and legal compliance

•Prepare contingency plans for different scenarios

Phase 2: Legal and Financial Preparation (Months 2-4)

Entity Restructuring:

•Establish new legal entities in target jurisdictions

•Transfer assets and operations to optimized structure

•Ensure compliance with all relevant tax and regulatory requirements

•Set up banking and financial services in new jurisdictions

Tax Planning:

•Work with international tax advisors to optimize structure

•Plan timing of moves to minimize tax obligations

•Establish tax residency in target jurisdiction

•Implement ongoing tax compliance systems

Operational Preparation:

•Set up remote work infrastructure and systems

•Transition customer service and operations to new structure

•Prepare team and stakeholders for geographic changes

•Test all systems and processes from new location

Phase 3: Execution and Optimization (Months 4-6)

Physical Relocation:

•Execute move to new operational base

•Establish local presence and infrastructure

•Build local networks and professional relationships

•Optimize daily operations for new environment

Business Transition:

•Complete transfer of operations to new structure

•Launch marketing and customer communication about changes

•Monitor business metrics and customer satisfaction

•Make adjustments based on real-world experience

Continuous Optimization:

•Track performance against optimization goals

•Monitor regulatory and tax changes in all jurisdictions

•Plan future adjustments and improvements

•Build systems for ongoing geographic flexibility

💎 REAL-WORLD CASE STUDY: THE CARIBBEAN TRANSITION

Let me share a real-world example of how advanced geographic optimization works in practice:

The Challenge: Operating a complex DAE ecosystem from a high-tax, high-regulation jurisdiction while serving a global customer base and managing significant crypto assets.

The Strategic Solution:

Operational Relocation: East St. Louis → Dominican Republic

•13-day transition timeline with full operational continuity

•Maintained all business operations through remote infrastructure

•Optimized for Caribbean time zone advantages and cost efficiency

•Preserved quality of life while dramatically reducing operational costs

Legal Structure Optimization:

•Maintained US entities for customer-facing operations and compliance

•Established Caribbean entities for operational efficiency

•Structured IP and treasury management for tax optimization

•Created clear separation between different business functions

Technical Infrastructure:

•Leveraged existing decentralized blockchain infrastructure

•Maintained AI agent operations across multiple cloud providers

•Ensured no single point of failure or jurisdiction dependency

•Optimized for global customer service and support

Regulatory Compliance:

•Maintained full compliance with US regulations for US customers

•Optimized Caribbean operations for local regulatory environment

•Structured token operations for maximum regulatory clarity

•Built flexibility for future regulatory changes

The Results:

•Reduced operational costs by 60-70% while maintaining service quality

•Optimized tax structure for long-term wealth preservation

•Improved work-life balance and operational flexibility

•Enhanced ability to serve global customer base

•Maintained full regulatory compliance in all relevant jurisdictions

Why This Works: The strategy leverages the best aspects of multiple jurisdictions while maintaining operational coherence and regulatory compliance. The DAE architecture enables this optimization because operations are largely location-independent.

🔥 ADVANCED STRATEGIES: BEYOND BASIC OPTIMIZATION

Once you master basic jurisdictional optimization, these advanced strategies become available:

The Rotating Residency Strategy

•Maintain tax residency in multiple jurisdictions through strategic timing

•Leverage visa programs and investment residency options

•Optimize for different life phases and business needs

•Build global networks and opportunities

The Sovereign Individual Approach

•Minimize dependence on any single jurisdiction or government

•Build wealth and operations that can't be easily controlled or confiscated

•Maintain multiple citizenship and residency options

•Create antifragile systems that benefit from global instability

The Ecosystem Arbitrage Model

•Take advantage of different regulatory environments for different business functions

•Leverage time zone differences for 24/7 operations

•Access different talent pools and cost structures globally

•Build competitive advantages through geographic optimization

The Regulatory Sandbox Strategy

•Operate in jurisdictions with experimental regulatory frameworks

•Participate in regulatory development and policy creation

•Build relationships with forward-thinking regulators

•Influence the development of crypto-friendly regulations

⚡ COMMON PITFALLS AND HOW TO AVOID THEM

Learn from the mistakes that have cost other DAE builders millions:

Pitfall 1: Ignoring Tax Implications Moving jurisdictions without proper tax planning can create massive unexpected liabilities.

Solution: Work with international tax advisors before making any moves. Plan transitions carefully to minimize tax obligations.

Pitfall 2: Underestimating Compliance Complexity Different jurisdictions have different requirements that can conflict with each other.

Solution: Build compliance expertise for each jurisdiction where you operate. Maintain clear separation between different business functions.

Pitfall 3: Creating Operational Dependencies Optimizing for one jurisdiction while creating dependencies that limit future flexibility.

Solution: Design operations to be location-independent from the beginning. Avoid creating single points of failure.

Pitfall 4: Neglecting Relationship Building Focusing only on regulatory and tax optimization while ignoring local networks and relationships.

Solution: Invest time in building local professional networks and understanding cultural contexts in each jurisdiction.

Pitfall 5: Over-Optimizing for Current Conditions Building structures that work perfectly for current regulations but can't adapt to changes.

Solution: Build flexibility into your structure. Plan for regulatory changes and maintain multiple options.

🌀 THE CONSCIOUSNESS ELEMENT: GLOBAL CITIZENSHIP

Geographic optimization isn't just about taxes and regulations—it's about expanding your consciousness and understanding of the world:

Cultural Intelligence Development

•Living in different cultures expands your perspective and creativity

•Understanding different business practices improves your global operations

•Building relationships across cultures strengthens your network and opportunities

•Experiencing different systems helps you design better DAE governance

Global Perspective Integration

•Seeing how different societies solve similar problems

•Understanding regulatory approaches and their trade-offs

•Appreciating different values and priorities across cultures

•Building empathy and understanding for diverse stakeholders

Sovereignty Consciousness

•Understanding the relationship between individual and state sovereignty

•Experiencing different levels of economic and political freedom

•Building systems that transcend traditional geographic limitations

•Creating value that serves global human flourishing

💎 YOUR GEOGRAPHIC OPTIMIZATION ROADMAP

Ready to optimize your DAE's geographic strategy? Here's your implementation roadmap:

Month 1: Assessment and Research

•Analyze your current situation and optimization opportunities

•Research target jurisdictions for different business functions

•Consult with international tax and legal advisors

•Define your optimization priorities and constraints

Month 2-3: Strategic Planning

•Design your optimal jurisdictional structure

•Plan entity creation and asset transfer strategies

•Prepare operational transition plans

•Build professional networks in target jurisdictions

Month 4-6: Implementation

•Execute legal and financial restructuring

•Begin operational transitions and relocations

•Implement new compliance and operational systems

•Monitor results and make adjustments

Month 7-12: Optimization and Scaling

•Fine-tune operations based on real-world experience

•Expand into additional markets and jurisdictions

•Build advanced strategies for ongoing optimization

•Plan next phase of geographic expansion

🔥 THE FUTURE OF BORDERLESS BUSINESS

Geographic optimization is just the beginning. Here's what's coming that will further transform location strategy:

Digital Nomad Visas: More countries offering special visa programs for remote workers and entrepreneurs Crypto-Friendly Jurisdictions: Increasing competition between countries to attract blockchain businesses Regulatory Harmonization: International coordination on crypto regulations reducing compliance complexity Virtual Residency Programs: Digital citizenship and residency options that don't require physical presence Decentralized Governance: DAOs that operate across borders with minimal traditional legal structure

The key is building systems that can take advantage of these developments as they emerge while maintaining operational excellence and regulatory compliance.

Your geographic strategy should feel like a competitive advantage that compounds over time. When you optimize correctly, you get better economics, more flexibility, and access to global opportunities while your competitors remain constrained by traditional location thinking.

Tomorrow, we'll explore how to design sustainable tokenomics that align incentives, create value, and scale with your community growth.

Next Transmission Preview: "Token Economics That Actually Work: Designing Sustainable Value Systems" - We'll dive deep into tokenomics design, incentive alignment, and creating economic systems that reward value creation while preventing manipulation and collapse.

From global operations to economic design: your sustainable tokenomics journey begins.